Whether you’re trying to save for a big purchase, pay off debt, or simply gain control over your finances, having effective budgeting strategies in place is crucial. By carefully analyzing your income and expenses, you can identify areas where you might be overspending and make necessary adjustments. From tracking your expenses to setting realistic financial goals, this article will provide you with practical tips and techniques to help you better manage your finances and achieve financial stability.

Check out our Recommend Products

1. Tracking Expenses

1.1 Manual Tracking

Tracking your expenses is an essential first step in effectively managing your finances. One of the simplest ways to do this is by manually tracking your expenses. This involves keeping a record of all your purchases and expenditures in a notebook or spreadsheet. By writing down every expense, no matter how small, you’ll gain a clear understanding of where your money is going and be able to identify any unnecessary or excessive spending.

1.2 Using Budgeting Apps

If manually tracking your expenses feels overwhelming or time-consuming, using budgeting apps can be a great alternative. There are numerous budgeting apps available that can help you easily track and organize your expenses. These apps often work by connecting to your bank accounts and credit cards, automatically categorizing your expenses, and providing you with detailed spending reports. Some popular budgeting apps include Mint, YNAB (You Need a Budget), and Personal Capital.

2. Creating a Budget

2.1 Identify Income

To create an effective budget, you first need to identify your sources of income. This includes your regular salary or wages, as well as any additional income from side jobs or investments. Knowing your total income is crucial in order to understand how much money you have available to allocate towards your various expenses and financial goals.

2.2 List Fixed Expenses

Fixed expenses are the recurring expenses that stay relatively constant from month to month. These typically include rent or mortgage payments, utilities, insurance premiums, and loan repayments. Listing all your fixed expenses helps you have a clear picture of your necessary financial obligations and ensures they are prioritized in your budget.

2.3 Account for Variable Expenses

Variable expenses are the costs that can fluctuate from month to month. These may include groceries, dining out, entertainment, clothing, and transportation costs. Tracking your variable expenses over a few months can give you a realistic idea of how much you typically spend in these categories. It’s important to account for these expenses in your budget, as they can greatly impact your overall financial health.

2.4 Allocate for Savings and Investments

Saving and investing should be an integral part of your budget. Allocating a portion of your income towards savings allows you to build an emergency fund, save for specific goals, and invest for long-term financial growth. Determine how much you can comfortably set aside each month and make it a priority in your budget. Remember, saving and investing are not only about preparing for the future but also about giving yourself financial peace of mind.

3. Prioritizing Financial Goals

3.1 Short-Term Goals

When managing your finances, it’s important to set and prioritize your financial goals. Short-term goals are those that you aim to achieve within the next year or so. These could include saving for a vacation, paying off a credit card debt, or building an emergency fund. By clearly defining your short-term goals, you can allocate the necessary funds in your budget and work towards achieving them.

3.2 Long-Term Goals

Long-term goals are the financial objectives you strive to achieve over a longer time horizon, typically several years or even decades. Examples of long-term goals include saving for retirement, buying a house, or funding your child’s education. It’s crucial to identify your long-term goals and incorporate them into your budget. By consistently saving and investing towards these goals, you’ll be well on your way to securing your financial future.

4. Implementing the 50/30/20 Rule

4.1 Calculate Your Essentials

The 50/30/20 rule is a popular budgeting strategy that helps ensure a balance between your needs, wants, savings, and debt repayment. The first step is to calculate your essential expenses, which should ideally account for 50% of your after-tax income. This includes your fixed expenses like rent, utilities, groceries, transportation costs, and healthcare. Understanding how much of your income should go towards these essentials will help you prioritize them within your budget.

4.2 Determine Your Wants

The next step is to determine your wants, which should ideally make up around 30% of your after-tax income. Wants are the non-essential expenses that bring you joy and improve your lifestyle, such as dining out, travel, entertainment, and hobbies. By setting limits on your discretionary spending, you can ensure that your wants are balanced with your other financial priorities.

4.3 Allocate Savings and Debt Repayment

The remaining 20% of your after-tax income should be allocated towards saving and debt repayment. This includes building your emergency fund, contributing to retirement accounts, saving for long-term goals, and paying off any outstanding debts. By consistently setting aside this portion of your income, you can strengthen your financial foundation and work towards a more secure future.

5. Using Envelopes or Cash Envelope System

5.1 Categorize Expenses

For individuals who prefer a more hands-on approach to budgeting, using envelopes or a cash envelope system can be an effective strategy. Start by categorizing your expenses into different envelopes based on your budget categories, such as groceries, dining out, transportation, entertainment, and personal expenses. This physical division of cash helps you visually track your spending and lets you know when you’ve reached your spending limit in a particular category.

5.2 Allocate Cash in Envelopes

Once you have your envelopes set up, allocate the appropriate amount of cash for each category at the beginning of the month. As you incur expenses within each category, use cash from the respective envelope. This system forces you to be mindful of your spending, as once the cash is gone from a particular envelope, you’ll need to wait until the next month or reallocate funds from another envelope. It can help you become more disciplined and focused on sticking to your budget.

6. Automating Payments

6.1 Set Up Automatic Bill Pay

Automating your bill payments is a convenient and efficient way to ensure that your essential expenses are always paid on time. Set up automatic bill pay with your bank or through online payment portals offered by your service providers. This helps you avoid late fees, penalties, and potential damage to your credit score. By automating these payments, you free up mental space and reduce the risk of forgetting to pay a bill.

6.2 Schedule Automatic Transfers

In addition to automating bill payments, it’s beneficial to schedule automatic transfers to your savings and investment accounts. Set up recurring transfers from your checking account to your designated savings or investment accounts on a regular basis. This will help you stay consistent with your saving goals and make it easier to stick to your budget. Automating transfers also removes the temptation to spend money that you had intended to save.

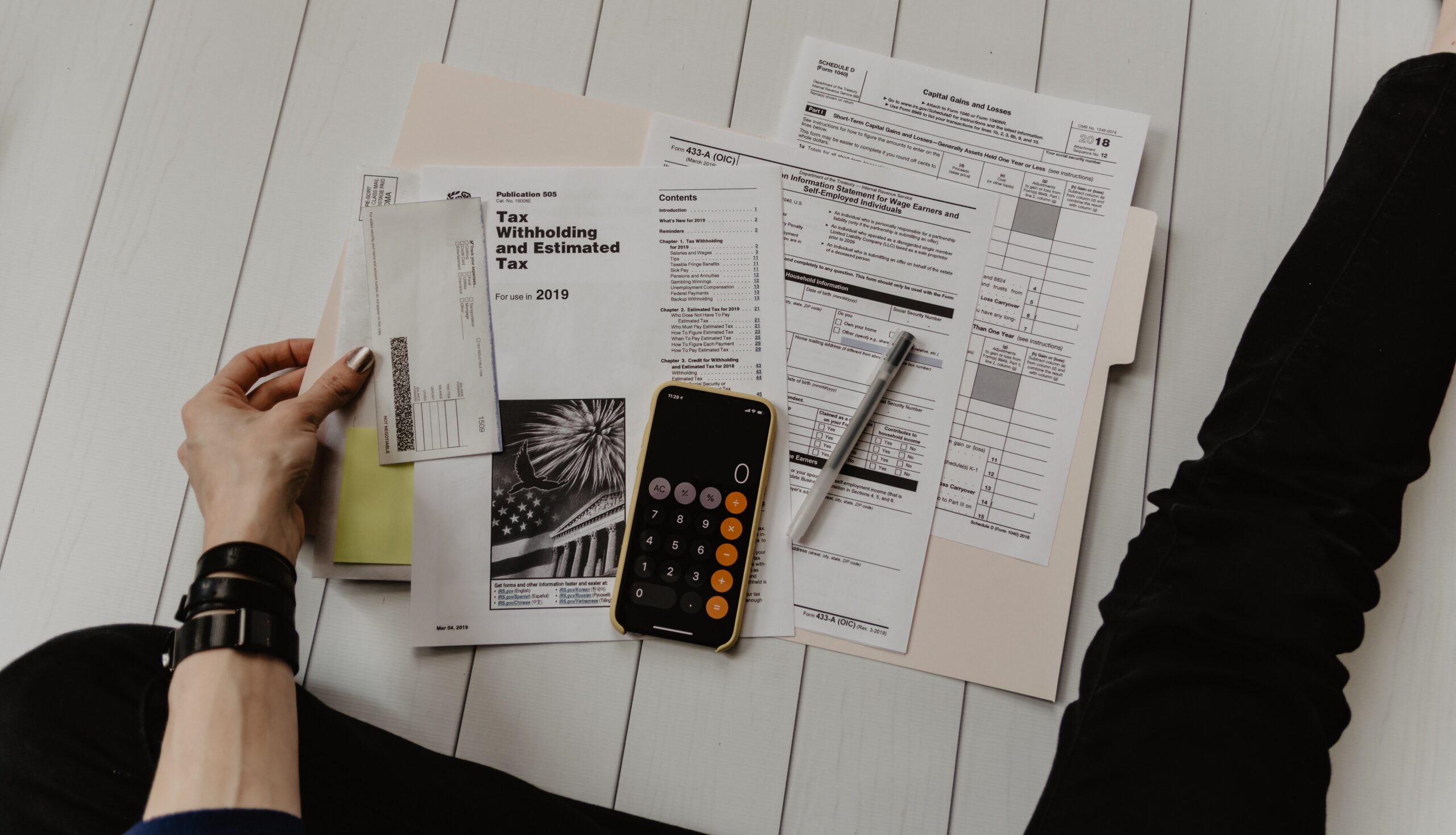

7. Minimizing Debt

7.1 Create a Debt Repayment Plan

If you have existing debts, it’s essential to create a debt repayment plan as part of your budget. Start by listing all your debts, including credit card balances, student loans, car loans, and personal loans. Prioritize your debts based on interest rates and consider using either the debt avalanche method (paying off the highest interest debt first) or the debt snowball method (paying off the smallest balance first). Allocate a specific amount in your budget towards debt repayment and stick to your plan until all debts are paid off.

7.2 Prioritize High-Interest Debt

When prioritizing debt repayment, it’s generally recommended to focus on high-interest debt first. High-interest debts, such as credit card balances, tend to accrue more interest over time and can significantly impact your financial well-being. By paying off these debts sooner rather than later, you’ll save money on interest payments and accelerate your path to financial freedom.

8. Avoiding Impulsive Purchases

8.1 Practicing the 24-Hour Rule

Impulse purchases can derail your budget and hinder your progress towards financial goals. To avoid succumbing to impulsive spending, practice the 24-hour rule. Whenever you have the urge to make a non-essential purchase, wait for at least 24 hours before making a decision. During this time, ask yourself if the item is truly necessary or if it aligns with your financial priorities. Often, the waiting period allows you to reassess and realize that the purchase was driven by impulse rather than genuine need.

8.2 Finding Alternatives to Retail Therapy

Retail therapy, or using shopping as a way to cope with negative emotions, can lead to excessive spending and financial stress. Instead of turning to retail therapy, explore alternative ways to manage your emotions and find fulfillment. Engage in hobbies, exercise, spend time with loved ones, or practice mindfulness and self-care. By finding healthier coping mechanisms, you can avoid unnecessary spending and maintain a balanced budget.

9. Reviewing and Adjusting the Budget

9.1 Regularly Review Expenses

To ensure that your budget remains effective, it’s crucial to regularly review your expenses. Set aside time each month to analyze your spending patterns and compare them to your budget. Identify any areas where you may have overspent or areas where you have saved more than expected. This ongoing review process allows you to make necessary adjustments and maintain control over your finances.

9.2 Identify Areas for Improvement

As you review your budget, be open to identifying areas for improvement. Look for opportunities to cut back on expenses, negotiate better rates on bills, or find more affordable alternatives for certain products or services. Continually seeking ways to optimize your budget and save money can lead to significant long-term financial benefits.

10. Seeking Professional Advice

10.1 Consult with a Financial Planner

If you’re struggling to manage your finances or have specific financial goals that require expert assistance, consider consulting with a financial planner. A financial planner can help you create a personalized budget, develop a comprehensive financial plan, and provide guidance on investments, retirement planning, and debt management. They can help you navigate complex financial situations and optimize your path to financial success.

10.2 Speaking with a Credit Counselor

For individuals facing overwhelming debt or struggling to meet their financial obligations, speaking with a credit counselor can provide valuable support. Credit counselors are trained professionals who can help you develop a debt management plan, negotiate with creditors, and provide personalized recommendations for improving your financial situation. They can also offer guidance on credit repair, budgeting strategies, and avoiding future financial pitfalls.

In conclusion, implementing effective budgeting strategies is key to managing your finances successfully. By tracking your expenses, creating a budget, prioritizing financial goals, implementing budgeting rules, using cash envelope systems, automating payments, minimizing debt, avoiding impulsive purchases, regularly reviewing and adjusting your budget, and seeking professional advice when needed, you can gain control over your finances, reduce financial stress, and work towards achieving your financial dreams. Remember, it’s never too late to start budgeting and taking control of your financial future.