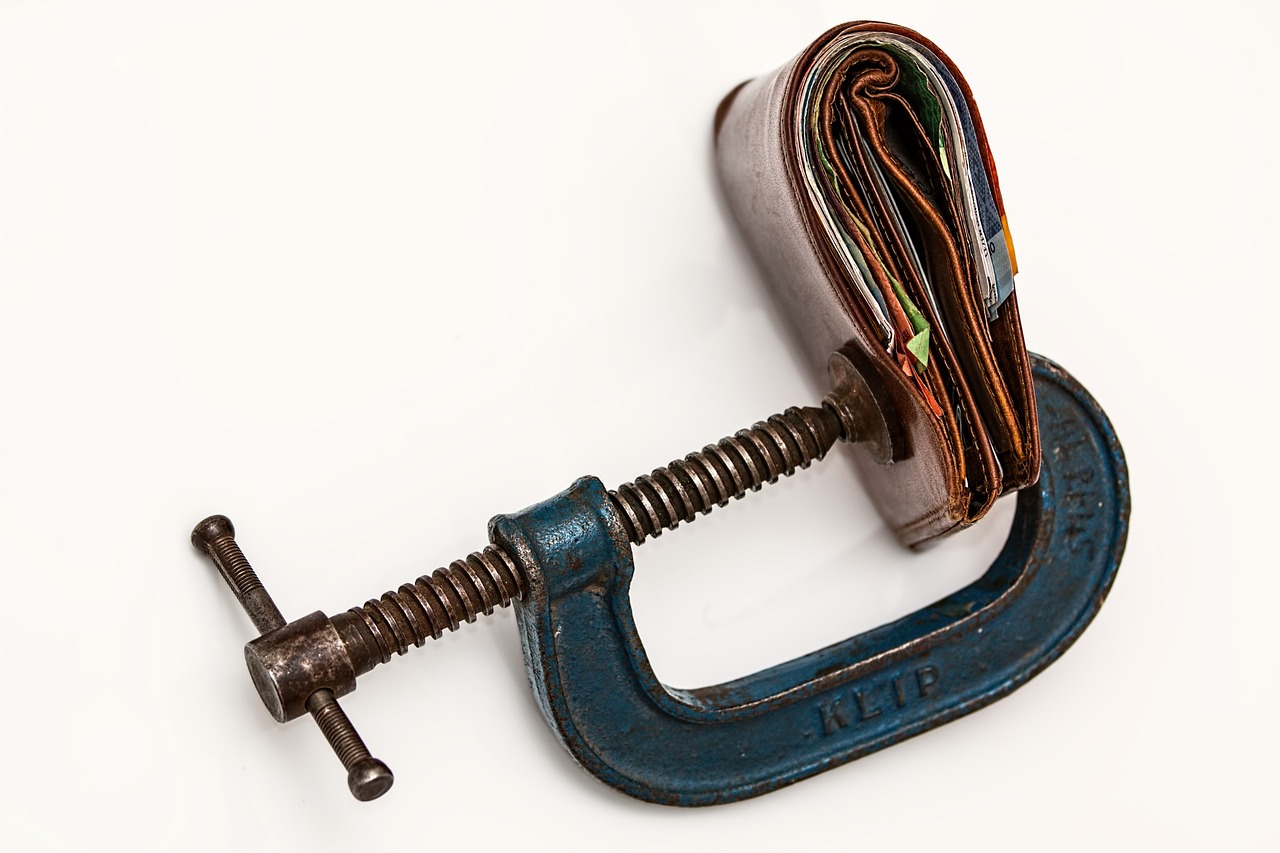

In times of economic recessions, it’s natural to question how our budgeting strategies should adapt. The uncertainties that come with these downturns can leave us feeling anxious about our financial stability. However, fear not! This article will guide you through the process of budgeting effectively during economic recessions, ensuring that you can navigate these challenging times with confidence. Whether you’re an individual, a family, or a small business owner, understanding the nuances of recession-era budgeting can help you thrive amidst economic uncertainties. So, let’s dive in and explore the strategies that will empower you to maintain financial stability, even during the most challenging economic times.

1. Importance of Budgeting During Economic Recessions

1.1 Understanding the Impact of Economic Recessions on Budgeting

During economic recessions, it becomes even more crucial to prioritize budgeting. Recessions often lead to job losses, reduced income, and increased financial uncertainty. Understanding the impact of economic recessions on budgeting allows you to proactively manage your finances and navigate through these challenging times.

1.2 The Role of Budgeting in Financial Stability during Recessions

Budgeting plays a vital role in maintaining financial stability during economic recessions. It enables you to have a clear overview of your income and expenses, helping you identify areas where you can cut back and save. By carefully managing your finances, you can establish a safety net, reduce debt, and create a sense of stability and control amid economic uncertainties.

1.3 Common Budgeting Challenges in Economic Recessions

Economic recessions present unique challenges when it comes to budgeting. It’s important to acknowledge and address these challenges to effectively manage your finances. Some common budgeting challenges during recessions include job insecurity, reduced income, inflation, increasing debt, and unexpected expenses. By recognizing these challenges, you can develop strategies to mitigate their impact on your financial well-being.

2. Evaluating Current Financial Situation

2.1 Assessing Income Stability

The first step in budgeting during an economic recession is evaluating your current income stability. Assess whether your income is likely to remain steady or if there are potential risks like job layoffs or reduced work hours. By understanding your income stability, you can make informed decisions regarding your budgeting priorities and identify areas where adjustments may be necessary.

2.2 Reviewing Expenses and Identifying Non-Essential Items

In times of economic uncertainty, it’s crucial to review your expenses and identify non-essential items. Start by categorizing your expenses into essential and non-essential categories. Essential expenses include items like housing, utilities, groceries, and transportation, while non-essential expenses can include dining out, entertainment, and subscriptions. By cutting back on non-essential items, you can free up funds to allocate towards essential expenses or savings.

2.3 Analyzing Debt and Loan Obligations

Another important aspect of evaluating your financial situation during a recession is analyzing your debt and loan obligations. Take the time to review all outstanding debts, such as credit card balances, student loans, and mortgages. Consider renegotiating repayment terms or exploring government assistance programs to alleviate the burden of debt during this challenging period. Analyzing your debt allows you to make informed decisions about prioritizing repayments and reducing financial strain.

3. Revising Income Sources and Strategies

3.1 Exploring Additional Income Opportunities

During economic recessions, it may be necessary to explore additional sources of income to supplement your main source of earnings. Look for freelance or part-time job opportunities that align with your skills and interests. This can provide a much-needed financial boost during uncertain times. Additionally, consider leveraging your talents or hobbies to generate income, such as offering online tutoring, selling handmade crafts, or providing freelance services.

3.2 Evaluating Job Security and Considering Alternative Employment

Assess your job security and evaluate whether your current employment may be at risk during an economic recession. If you anticipate potential job loss, it’s crucial to proactively consider alternative employment options. Update your resume, network with professionals in your field, and explore industries that may be more resilient during a recession. Being prepared and open to alternative employment opportunities can help you maintain a stable income during challenging times.

3.3 Maximizing Benefits and Government Support

During economic recessions, it’s important to maximize the benefits and government support available to you. Research and understand the various assistance programs, unemployment benefits, and financial aid options that may be applicable in your situation. By leveraging these resources, you can alleviate some financial pressures and give yourself a better chance of navigating through the recession with financial stability.

4. Adjusting Budget Categories

4.1 Prioritizing Essential Expenses

When budgeting during economic recessions, it becomes crucial to prioritize essential expenses. These include housing, utilities, groceries, transportation, and healthcare. Allocate a significant portion of your budget towards these essential items, ensuring that you have the necessary funds to cover them. By prioritizing essential expenses, you can maintain a stable living situation and ensure your basic needs are met.

4.2 Cutting Back on Discretionary Spending

In times of economic uncertainty, it’s essential to cut back on discretionary spending. Evaluate your non-essential expenses and identify areas where you can make reductions. This may involve eliminating unnecessary subscriptions, reducing dining out, and finding cost-effective alternatives for entertainment. By cutting back on discretionary spending, you can free up funds to allocate towards essential expenses or savings.

4.3 Allocating Funds for Emergency Savings

Building and maintaining an emergency savings fund is crucial during economic recessions. Aim to allocate a portion of your budget towards savings, specifically for emergencies. This fund can provide a safety net in case of unexpected expenses or job loss. Consider automating your savings contributions to ensure consistency and discipline in growing your emergency fund over time.

5. Managing Debt and Loan Repayments

5.1 Negotiating with Creditors and Lenders

If you find yourself struggling to meet debt and loan repayments during an economic recession, it’s important to proactively communicate with creditors and lenders. Reach out to them and explain your circumstances, expressing the challenges you’re facing. Many financial institutions and creditors are open to negotiation and may be willing to provide temporary payment adjustments or alternative repayment options during times of financial hardship.

5.2 Restructuring Debt Payments

In situations where negotiating with creditors is not feasible, explore the option of restructuring your debt payments. This may involve consolidating loans, refinancing mortgages, or enrolling in debt management programs. Restructuring debt payments can help lower monthly obligations and provide some relief amidst economic uncertainties. However, it’s important to carefully consider the terms and conditions associated with any debt restructuring options.

5.3 Seeking Financial Counseling and Assistance

If you feel overwhelmed by your debt and loan obligations, seeking professional financial counseling can be beneficial. Financial counselors can provide guidance, create debt management plans, and help you navigate through challenging financial situations. Additionally, explore nonprofit organizations and government agencies that offer financial assistance programs or counseling services. Remember, seeking help is a sign of strength and can significantly improve your financial well-being.

6. Saving Strategies for Economic Uncertainty

6.1 Building an Emergency Fund

Building an emergency fund is essential during economic uncertainty. Aim to save three to six months’ worth of living expenses to provide a financial buffer in case of job loss or unexpected expenses. Start by setting aside a small portion of your income each month towards your emergency fund and gradually increase your savings as you can. This fund will provide peace of mind and financial security during economic recessions.

6.2 Automating Savings Contributions

Automating your savings contributions is an effective strategy to ensure consistent and disciplined saving habits. Set up an automatic transfer from your checking account to a separate savings account every month. By doing so, you won’t have to rely solely on willpower to save. Automating savings contributions creates a “set it and forget it” approach, allowing your savings to grow without requiring regular manual transfers.

6.3 Exploring Investment Opportunities

While economic recessions may be a time of uncertainty, there may also be investment opportunities that arise. Research investment options that align with your risk tolerance and long-term financial goals. Consider diversifying your investments to spread risk and explore strategies such as dollar-cost averaging. It’s important, however, to exercise caution and seek advice from a financial advisor before making any investment decisions.

7. Monitoring and Tracking Expenses

7.1 Utilizing Budgeting Tools and Apps

To effectively manage your budget during an economic recession, utilize budgeting tools and apps. These tools can automate expense tracking, categorize spending, and provide visual representations of your financial situation. Popular budgeting apps like Mint, YNAB (You Need a Budget), and PocketGuard are user-friendly and can help you stay organized and aware of your expenses in real-time.

7.2 Following a Cash-Only Approach

Consider adopting a cash-only approach when it comes to managing your everyday expenses. This can help you develop a stronger sense of control and prevent unnecessary spending. Withdraw a predetermined amount of cash each month for your discretionary expenses, such as groceries and entertainment. By using cash, you’ll have a tangible representation of your spending, making it easier to track and avoid overspending.

7.3 Reviewing and Adjusting Budget Regularly

To ensure your budget remains effective during an economic recession, it’s essential to review and adjust it regularly. As your financial situation and priorities might change, it’s important to stay proactive. Set aside time each month to review your budget, track your expenses, and make necessary adjustments. By regularly reviewing your budget, you can identify areas for improvement, identify potential cuts, and make informed decisions about your finances.

8. Anticipating Market Volatility and Planning Ahead

8.1 Understanding Economic Indicators

To effectively anticipate market volatility and plan ahead during economic recessions, it’s crucial to understand economic indicators. Stay informed about indicators like GDP growth, unemployment rates, and inflation. This knowledge will help you make informed financial decisions and adjust your budgeting strategies accordingly. Keep an eye on economic news and consult reputable sources to stay informed about the state of the economy.

8.2 Diversifying Investments

Diversifying your investments is an essential strategy to minimize risk during economic recessions. Allocate your investments across different asset classes, such as stocks, bonds, and real estate. By diversifying your portfolio, you reduce exposure to a single investment and increase the potential for long-term growth. Consult with a financial advisor to ensure your investment strategy aligns with your risk tolerance and goals.

8.3 Establishing Long-Term Financial Goals

During economic recessions, it’s important to focus on long-term financial goals rather than short-term fluctuations. Establish clear, realistic goals that align with your values and aspirations. Whether it’s saving for retirement, purchasing a home, or funding your children’s education, having clear goals provides motivation and direction. By maintaining a long-term perspective, you can navigate through economic uncertainties with greater confidence and resilience.

9. Adapting to Lifestyle Changes

9.1 Embracing Frugality and Minimalism

Adopting a frugal and minimalist lifestyle can help you adapt to economic recessions. Embrace the concept of “less is more” and focus on what truly matters to you. Prioritize experiences over material possessions, practice mindful spending, and seek satisfaction from non-material sources of happiness. By embracing frugality and minimalism, you can reduce financial stress and gain greater control over your finances.

9.2 Exploring DIY and Cost-Saving Measures

In times of economic uncertainty, exploring DIY and cost-saving measures can significantly impact your budget. Look for opportunities to repair or repurpose items instead of buying new ones. Consider cooking at home rather than dining out, growing your own vegetables, or even exploring self-sufficiency practices like composting and reducing waste. By adopting these measures, you can save money and develop valuable skills along the way.

9.3 Rethinking Travel and Leisure Expenses

Travel and leisure expenses often take a significant portion of one’s budget. During economic recessions, it’s important to reconsider and adjust your approach to these expenses. Look for affordable local destinations instead of costly international trips. Consider alternative forms of entertainment, such as hiking, visiting local museums, or joining community events. By rethinking your approach to travel and leisure, you can enjoy fulfilling experiences while staying within your budget.

10. Seeking Professional Financial Advice

10.1 Consulting with a Financial Advisor

In times of economic uncertainty, seeking professional financial advice can provide invaluable guidance. A financial advisor can help you navigate through complex financial decisions, provide personalized strategies, and offer peace of mind. They can help you develop a comprehensive budgeting plan, assess investments, and make informed decisions about your financial goals. When seeking a financial advisor, choose a reputable professional with relevant experience and qualifications.

10.2 Exploring Government Resources and Programs

Governments often offer resources and programs to support individuals during economic recessions. Take the time to research and explore the various options available in your country or local area. These resources can include unemployment benefits, financial assistance programs, or job training initiatives. By leveraging government resources, you can make use of the support available and improve your financial stability during challenging times.

10.3 Joining Supportive Communities

During economic recessions, it can be helpful to connect with supportive communities that share similar financial challenges. Look for online forums, social media groups, or local community organizations that focus on financial well-being. These communities provide a space to share experiences, exchange tips, and offer support to one another. By joining supportive communities, you can gain valuable insights, find inspiration, and feel less isolated during challenging financial times.

In conclusion, budgeting during economic recessions is crucial for maintaining financial stability and navigating through uncertainties. Understanding the impact of recessions on budgeting, evaluating your financial situation, revising income sources and strategies, adjusting budget categories, and managing debt and loan repayments are essential steps. Additionally, implementing saving strategies, monitoring expenses, anticipating market volatility, adapting to lifestyle changes, and seeking professional advice can contribute to your financial well-being during economic recessions. Remember, with careful planning, flexibility, and informed decisions, you can successfully manage your finances and emerge stronger from any recession.