Introduction to Budgeting

Budgeting is an essential part of managing your finances. It helps you keep track of your income and expenses, plan for future goals, and save money. If you’re new to budgeting or struggling with financial management, here are some tips to help you get started.

Setting Financial Goals

The first step in creating a budget is setting financial goals. Think about what you want to achieve financially – whether it’s paying off debt, saving for retirement, or buying a house. Setting specific, measurable goals will help you stay motivated and focused on achieving them.

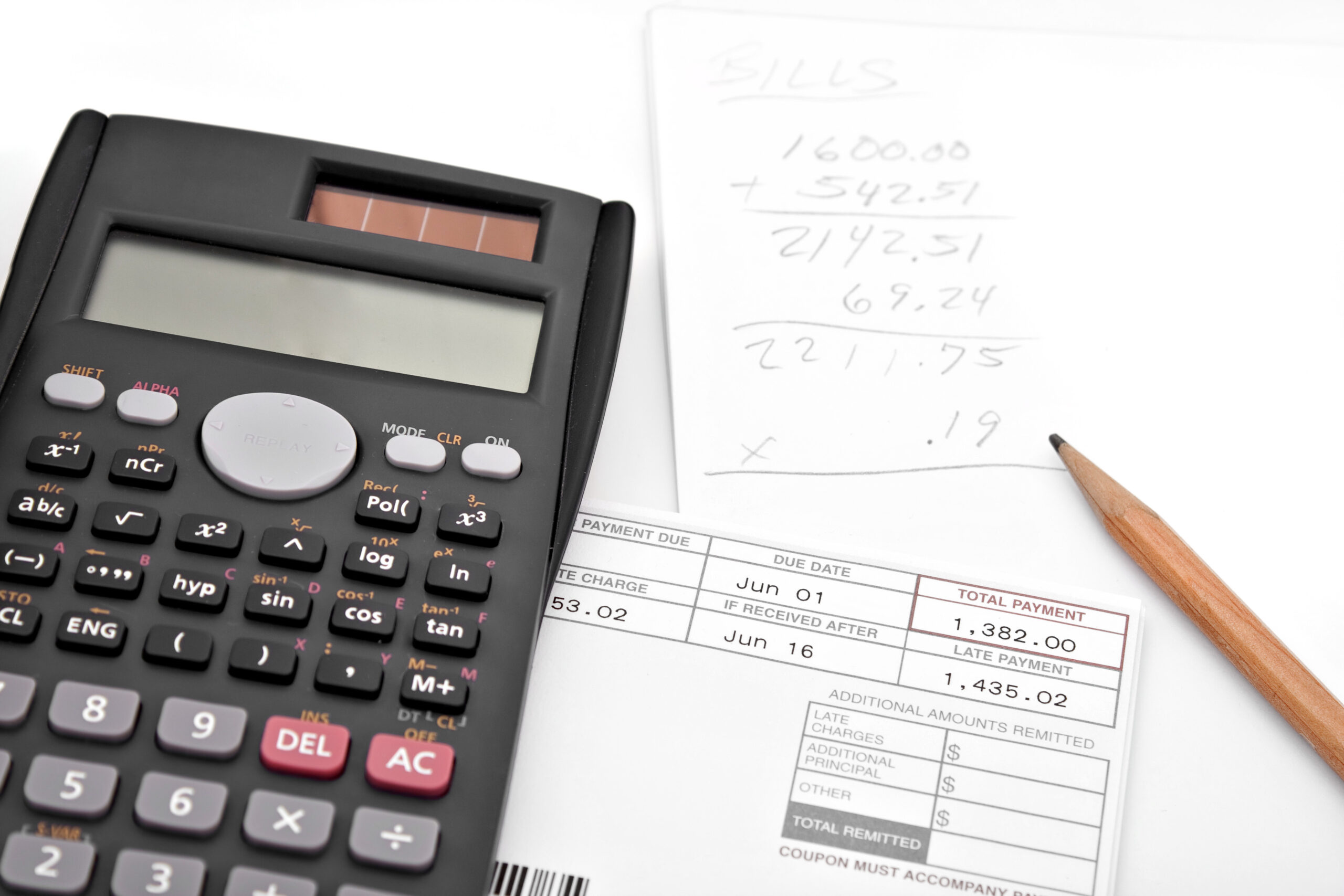

Creating a Monthly Budget Plan

Once you have set your financial goals, the next step is to create a monthly budget plan. List all your sources of income and expenses, including bills, groceries, transportation, entertainment, etc. Determine how much you can afford to spend each month while still meeting your financial goals. Make sure to allocate funds towards savings as well.

Tracking Your Expenses

To stick to your budget, tracking your expenses is crucial. Keep a record of every penny spent, including cash purchases. Use tools like spreadsheets or mobile apps to make this process easier. You may be surprised by where your money goes each month.

Cutting Back on Unnecessary Spending

After analyzing your spending habits, identify areas where you can cut back. Look at subscriptions, memberships, and other recurring costs that might not bring value to your life anymore. Consider reducing unnecessary expenses such as eating out less often, canceling unused subscriptions, and finding cheaper alternatives for household items.

Building an Emergency Fund

An emergency fund is essential for unexpected events like job loss, medical emergencies, or home repairs. Aim to build up three-to-six months worth of living expenses in a separate savings account. This way, if something happens, you won’t need to rely on credit cards or loans to cover the cost.

Investing for the Future

If you have extra money left over after covering your expenses and building an emergency fund, consider investing for the future. Start by contributing to your employer’s 401(k) plan or opening an IRA account. Research different types of investments and diversify your portfolio to minimize risk.

Managing Debt

If you have high-interest debt, focus on paying it off first. Create a debt payment plan and prioritize paying off the highest interest rate balances first. Consider consolidating multiple debts into one lower-interest loan or negotiate with lenders to reduce interest rates.

Saving Money on Everyday Items

Finally, look for ways to save money on everyday items. Shop around for better deals on utilities, insurance, and other regular expenses. Buy generic brands instead of name-brand products, use coupons when shopping, and eat out less frequently.

Conclusion and Final Tips

Remember, budgeting takes time and practice but is essential for achieving financial stability. Stick to your budget, review it regularly, and adjust as needed. Don’t forget to reward yourself occasionally for reaching milestones or achieving financial goals. Good luck!